Global House Prices

Prices rose at the fastest since 2005

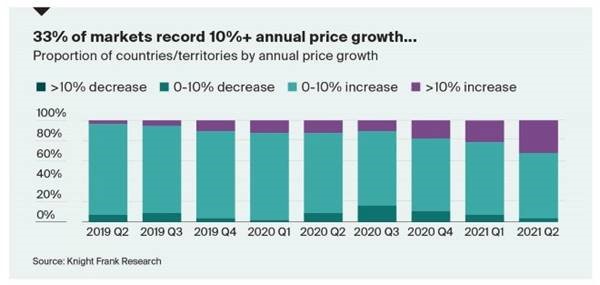

Global house prices rose at the fastest pace since 2005 during the second quarter as the pandemic-induced boom rolled on. Prices in a third of the 55 countries and territories we track are climbing at a rate of more than 10% (see chart). This isn't a global surge, however. The largest rises are mostly confined to advanced economies where support measures have protected jobs and enabled significant savings among consumers - see New Zealand (25.9%), the US (18.6%), Australia (16.4%) and Canada (16%).

China

More evidence that some measures introduced to cool house price growth in China are working. Limits on bank lending to the sector, upper limits on developer debt ratios and restrictions targeting speculators have slowed house price growth across China's major cities to a crawl. The FT, however, has this piece on the suspension of land auctions that indicates some measures are having the opposite effect.

Regulations introduced in February stipulated 22 cities should increase land sales this year at three large auctions, rather than dozens, in an attempt to create the impression of abundant supply. That didn't work out as intended. The FT report has details of a plot in Chongqing selling for 130% above asking price and developers creating numerous shell companies in order to get extra tickets for the draw. The house price data was released alongside a raft of economic indicators suggesting growth is under pressure amid new outbreaks of Covid-19. Retail sales growth dipped to 2.5% in August compared to a year earlier. Shares across Asia fell on the news.

The office

Interesting numbers from Metrikus reported in Property Week suggests office occupancy has reached 87%, the highest level since the world decamped to work from home in March 2020. It's unclear which definition of occupancy we're working with, whether it's buildings occupied or number of employees sitting at desks. By the latter definition, most offices were often about 60% occupied before the onset of the pandemic.

As Lee Elliott notes in our House View, ten of our 15 global gateway markets still report office occupancy below half of typical levels. Momentum is indeed building but there is still considerable road to run. It is unlikely that the current road brings a return to pre-pandemic levels of occupancy. Our re-entry into the office will instead be more fluid and flexible, reflecting a real shift in working styles. Meanwhile a flight to quality underway will intensify - 70% of office space committed to last quarter was new or fully refurbished, much higher than has historically been the case.

UK Jobs

Official figures reveal employers added 241,000 staff to the payroll in August, taking the total number above levels last seen in February 2020. It's a milestone worth celebrating, however the ONS warned of an uneven recovery, with employment in London and the hardest hit sectors such as hospitality, the arts and leisure remaining well down on pre-pandemic levels. Vacancies, meanwhile, hit a new record. The hospitality industry is finding it particularly hard to fill positions.

Los Angeles County Housing Report: The Autumn Calm