Global House Prices

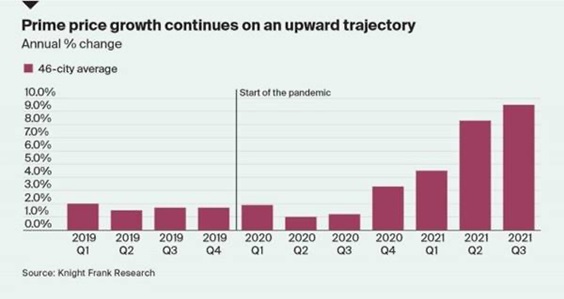

Prime price growth continues on an upward trajectory

You might have thought it was over by now, but no prime house price growth across the world’s cities continues to accelerate. Our Prime Global Cities Index, based on price performance of prime stock in 46 cities, surged by 9.5% in the year to September, up from the 8.3% recorded in June.

Some 85% of cities saw prices rise on an annual basis, up from 76% last quarter, and 16 cities (35%) saw prices increase by more than 10% during the 12-month period. Miami (26.4%) leads the index this quarter for the first time since the index started in 2007. The hunt for larger accommodation, coastal living, and Florida’s low taxes acted as a key draw for a new breed of remote workers in the US.

Amongst the 15 cities that saw their annual rate of growth decline in Q3 compared to the previous quarter are the four Chinese mainland cities we track: Shanghai, Beijing, Guangzhou and Shenzhen as well as Toronto and Vancouver.

The new world of work

A new paper from researchers at the Bank of England and the universities of Nottingham and Stanford predicts that demand for office space is likely to fall about 9% as a result of the pandemic.

The research is based on responses from the Bank of England’s Decision Maker Panel of around 3,000 UK companies. In 2019, that panel estimated that around 7% of the hours that their employees worked were from home. At the height of the pandemic, this share was as high as 60%. As of September that had fallen to 27% and is expected to settle at 20% over increase land sales this year at three large auctions, rather than dozens, in the medium term - a big moderation but still about a three-fold increase compared to pre-pandemic norms.

The expected use of office space is expected to fall (in terms of square footage) by 9%, while use of retail space is expected to be around 1% lower, with storage space increasing by around 2%. The theory is that for every 10% of extra hours worked from home, 3.1% less office space is expected to be used and investment in land and buildings will be 2.1% lower.

For the most up-to-date picture on how all this is impacting the capital, see the new London Office Market report. The market continues to recover and take-up is now 12.4% below the long-run quarterly average of 3 million square feet.

House building

Trading updates from Persimmon and Vistry reveal the strength of the new homes market. Reservation rates at Persimmon remain 16% above 2019 levels and Vistry’s forward sales position just hit £3 billion.

Vistry said it has continued to see pressure across the building materials supply chain, resulting in extended lead times, however there are now some signs of improvement. That tallies with the IHS Markit Purchasing Managers Index published last Friday.

Persimmon said that trading is now beginning to follow a more typical seasonal pattern, which is in line with our view that house price growth will moderate.

In other news..

Chris Druce with a roundup of this month’s key UK market data: spoiler - residential property market shrugs off end of stamp duty holiday.

Ryan Richards on why the care home sector is showing signs of recovery.

Will Matthews on the key economic and financial metrics for property investment sectors.

Elsewhere - materials firms facing Grenfell tax (Times), Bill Ackman tries to win neighbors’ support for glass NYC penthouse (FT), UK green funds attract record retail inflows (FT), and finally, the UK recovery is stalling not soaring (National Institute for Economic and Social Research).

Interest Rates Juicing the Market